CLIMATE PROSPERITY PLANS

Member nations of the Climate Vulnerable Forum and V20 Finance Ministers (CVF-V20) are not only on the frontlines of climate change but also face systemic financial barriers: high costs of capital, unsustainable debt levels, and limited fiscal space. These constraints undermine their ability to invest in low-carbon development and climate resilience.

To meet the scale of the challenge, finance flows must increase dramatically—fivefold from the current USD 90 billion to USD 490 billion annually by 2030. Only through such bold mobilization of resources can these nations pursue development pathways aligned with the goals of the Paris Agreement.

The Climate Prosperity Plans (CPPs) were created to directly address this challenge. First launched under Bangladesh’s Presidency, CPPs are pioneering, medium-to-long-term national investment strategies that integrate development, climate, and nature. They are designed to provide a structured and strategic framework for building project pipelines, attracting capital, and accelerating access to technology.

CPPs are not external but country-driven and owned national strategies that build on and help dramatically realize sector plans and development plans, such as the Nationally Determined Contributions and National Adaptation Plans. CPPs are more than just fully costed roadmaps for low-carbon and climate-resilient development; they are multi-phase national strategies for investment, technology sharing, joint development agreements, and knowledge transfer, designed specifically by countries for their particular, granular development realities and ambitions.

CPPs mobilize resources and foster collective action that transforms climate risks into bankable opportunities, with a focus on growth-guided climate and development investments, technology sharing and joint development agreements, new job creation, and the measurable reduction of climate-related fiscal risks.

A central feature of CPP implementation is the development of Green Economic Zones (GEZs) that are net-zero compatible and climate-resilient. These zones support export-oriented competitiveness, unlock the co-benefits of competitive exports substituting imports, drive robust policy and regulatory design to attract foreign and domestic investment, and map supply and value chain expansion to operationalize green industrial policy and targeted financing.

CPPs also promote economic cooperation opportunities, including initiatives such as the G7–V20 Global Shield against Climate Risks, to expand access to pre-arranged finance and mobilize timely support for households, enterprises, and public institutions facing climate shocks.

The development and implementation of each CPP is led by a government-designated coordination unit embedded in the finance and/or economic planning ministry, with support from the climate change or environment ministry.

KEY COMPONENTS OF CLIMATE PROSPERITY PLANS

Long-term Socio-economic Targets

The CPP sets ambitious targets for achieving sustained economic growth, poverty reduction, job creation, and improved living standards while integrating climate considerations into development planning.

Projects

and Programs

The CPP identifies specific programs and projects that contribute to achieving the set targets.

Financing

Options

The CPP outlines various financing mechanisms and sources to support the implementation of the plan’s projects and programs.

Legislation and

Regulations

The CPP provides an in-depth assessment of existing policy and regulatory frameworks related to climate change and development and provides recommendations for strengthening and aligning them with the objectives of the CPPs.

V20 SUPPORT IN THE IMPLEMENTATION OF CPPS

Action on the Ground

We provide regionally-based staff to continuously engage the government, track progress on projects, and represent interests to partners locally and globally.

Financing and Investment

We help with financial planning and investment options, organizing investor events, integrating funding initiatives into mobilization efforts, and coordinating support from philanthropic partners for projects/programs.

PRACTICE AND INNOVATION EXCHANGE

An exchange to codify and share proven delivery models—from policies to transactions—so CVF0-V20 governments, institutions, MSMEs, and investors can replicate what works, strengthen local capacity, reduce transaction costs, and unlock capital through locally rooted climate prosperity strategies.

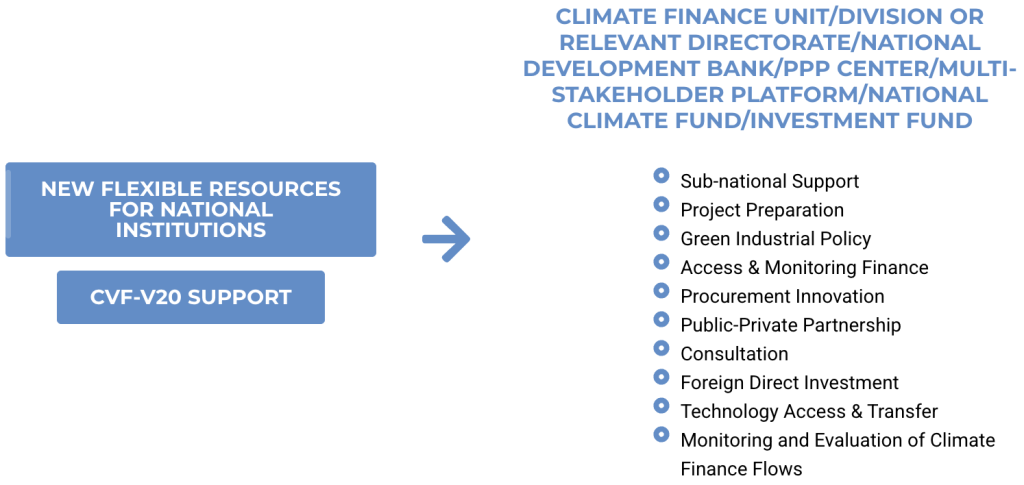

A 'RUNNING START' THROUGH DELIVERY UNITS / COUNTRY PLATFORMS

Delivery Units/Country Platforms are not new; they are mostly existing coordinating mechanisms that are now being strengthened to serve as catalytic vehicles connecting policy, finance, and delivery within national systems.

These delivery arrangements are mandated to support the design and implementation of their CPPs. These institutional arrangements—referred to as delivery units/country platforms—receive country-demanded technical assistance tailored to their needs. This includes macroeconomic modelling to build credible investment cases and ensure debt sustainability; investment in skilled national teams to lead project preparation, early-stage capital mobilization, financial structuring, and transaction advisory services to attract private and public investment; and support for preparing the requisite documentation to access vertical climate funds (such as Green Climate Fund, Global Environment Facility, Climate Investment Funds, etc.) and other relevant trust funds.

It also includes targeted efforts to strengthen national institutions, particularly planning bodies, national development banks, and regulatory agencies, ensuring they have the capabilities required to drive climate-resilient, investment-led growth.

CLIMATE FINANCE UNIT/DIVISION OR RELEVANT DIRECTORATE/NATIONAL DEVELOPMENT BANK/PPP CENTER/MULTI-STAKEHOLDER PLATFORM/NATIONAL CLIMATE FUND/INVESTMENT FUND

- Sub-national Support

- Project Preparation

- Green Industrial Policy

- Access & Monitoring Finance

- Procurement Innovation

- Public-Private Partnership

- Consultation

- Foreign Direct Investment

- Technology Access & Transfer

- Monitoring and Evaluation of Climate Finance Flows

AREAS OF SUPPORT

GREEN INDUSTRIAL POLICY AND STRATEGY DEVELOPMENT

Mainstreaming green industrial policy including utilizing green economic zones and through trade agreements.

PROJECT PIPELINE DEVELOPMENT

Supporting the structuring and financing of bankable climate projects.

MOBILIZING CLIMATE FINANCE

Accessing vertical climate funds, trust funds (e.g. RST), and building the case for de-risking, guarantees, first-loss, concessional capital, where relevant.

CLIMATE AND DISASTER RISK MANAGEMENT INSURANCE STRATEGY

Enhancing financial and social protection mechanisms against climate shocks, including Global Shield.

DOMESTIC FINANCIAL INSTITUTIONS AND CAPITAL MARKETS

Support green taxonomies, strengthening national development banks, and capital market access such as green bonds, etc.

CARBON MARKET ACCESS

Facilitating participation in carbon markets (Article 6.2 and Article 6.4).

PRIVATE SECTOR ENGAGEMENT

Creating incentives and partnerships to scale green investments, including investor forums.

REGIONAL AND INTERNATIONAL COOPERATION

Strengthening access to climate funds, bilateral agreements, and multilateral partnerships.

MODELING AND ANALYTICS FOR LONG-TERM LIABILITIES MANAGEMENT

Integrating climate prosperity and green economic modeling which includes natural capital and biodiversity, and analytics into debt sustainability frameworks, including structuring and managing debt-for-climate swaps, and strengthening credit ratings.

MONITORING AND EVALUATION

Establishing country-led key performance indicators and systems for project and program monitoring.

VALUE OF DELIVERY UNITS / COUNTRY PLATFORMS

The CVF-V20 recognizes the value that delivery units/country platforms can provide when countries are firmly in the driver’s seat, ensuring that resources are mobilized on their own terms through country-led and regionally led partnerships to achieve climate prosperity, not through externally imposed agendas.

We must move beyond fragmented coordination to mission-driven, government-led platforms that crowd in capital, align with national ambitions, and deliver real outcomes. It is in our interest to avoid default arrangements or glossy reports disconnected and produced far from the frontlines of delivery, untethered to local realities and inadequate to the sense of opportunity inspiring teams on the ground. From vast country-led experience, we know that when done right, these platforms can offer a running start for upstream project-development support, provide clear policy guidance, and serve as credible venues for alignment between governments and investors, including for carbon market access and debt-for-climate swaps.

They require flexible support that not only finances projects, but also finances the process of unlocking capital: project preparation, building pipelines, reducing transaction costs, strengthening and deepening local capital markets to diversify sources of capital, and enabling more responsive financing solutions.

Delivery units/country platforms can generate the evidence base required to enable an eventual transition to private-sector financing. To enable an eventual transition to increased private sector financing, there needs to be additional direct support to strengthen the private sectors in small island developing states and least developed countries, where micro, small, and medium enterprises lack the capital, face high transaction costs, and have limited labour markets, and private sector participation and cooperation at the sub-national level.

This requires fostering public-private partnerships and new forms of joint ventures to reduce transaction costs and advance human capital formation. There is no substitute for national and local capacity, whether public institutions, the private sector, universities, or civil society. We must avoid repeating past errors in which external actors or hubs have limited local agency.

PRACTICE AND INNOVATION EXCHANGE

Practice and Innovation Exchange aims to systematically capture, codify, and disseminate what works across delivery units/country platforms of climate prosperity strategies. This Exchange can enable governments, national institutions, MSMEs, and investors to access proven implementation models, transaction structures, policy instruments, and delivery approaches grounded in real economy experience, not abstract templates. It facilitates peer learning across V20 members and, perhaps, even among developing G20 countries, strengthens local institutional capacity, and accelerates the replication of successful public–private partnerships, green industrial policy approaches, carbon market participation models, debt swaps, and financial structuring options.

The Exchange can focus on ensuring knowledge sharing and transfer, reinforcing national agency, reducing reliance on external intermediaries, and driving down transaction costs across the full investment cycle. This can then focus on locally rooted capabilities for grounded delivery and to unlock capital on fairer terms.

CLIMATE PROSPERITY PLANS

Philippines Climate Prosperity Plan

(In Progress)

Pakistan Climate Prosperity Plan

(In Progress)

Bhutan Climate Prosperity Plan

(In Progress)

Haiti Climate Prosperity Plan

(In Progress)